Getting gynecomastia surgery covered by insurance can be a complex process, as coverage policies vary between insurance providers. However, here are some general steps you can take to increase your chances of getting coverage:

- Review your insurance policy: Carefully read your insurance policy to understand the coverage and exclusions related to gynecomastia surgery. Look for any specific requirements or criteria that need to be met.

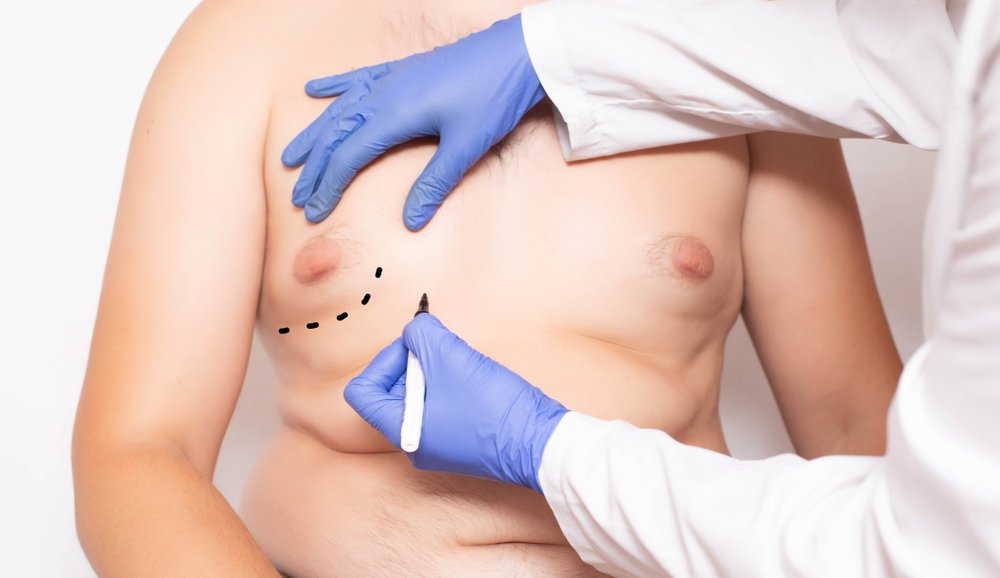

- Consult with your doctor: Schedule an appointment with a qualified plastic surgeon or a specialist experienced in gynecomastia treatment. They can evaluate your condition and provide documentation regarding the medical necessity of the surgery. Insurance companies typically require evidence that the procedure is medically necessary rather than purely cosmetic.

- Obtain supporting documents: Your doctor can help you gather the necessary documentation, such as medical records, diagnostic test results, and photographs, to support your case. This information should demonstrate the extent of your condition, any associated symptoms or discomfort, and the failure of alternative non-surgical treatments.

- Submit a pre-authorization request: Contact your insurance company and inquire about their pre-authorization process for gynecomastia surgery. Submit the required documents, including a letter of medical necessity from your doctor, along with any supporting evidence. Be sure to follow their specific instructions and deadlines.

- Follow up with your insurance company: Keep track of your pre-authorization request and regularly follow up with your insurance company to ensure they have received all the necessary information. Stay in communication with them to address any questions or concerns they may have.

- Appeal if necessary: If your initial request is denied, you have the option to file an appeal. Review the denial letter carefully to understand the reasons for the denial. Work with your doctor to strengthen your case and provide any additional information that may support the medical necessity of the surgery. Follow your insurance company’s appeal process and deadlines.

Remember, the process and requirements may vary depending on your specific insurance plan and provider. It’s important to thoroughly review your policy and consult with your insurance company for detailed information on coverage and the pre-authorization process.

Current Gynecomastia Surgery Discounts in Miami Clinics

| Clinic Name | Service | Offer | Link to Offer |

|---|---|---|---|

| Boutinic Aesthetics | Gynecomastia in Miami | $500 OFF | Get Offer |

| Moon Plastic Surgery Center | Gynecomastia in Miami | 10% Discount | Get Offer |

| Miami Lakes Cosmetics | Gynecomastia in Miami | $600 OFF | Get Offer |

When Does Health Insurance Cover Cosmetic Procedures?

Health insurance typically covers cosmetic procedures only when they are deemed medically necessary. The definition of “medically necessary” can vary among insurance companies, but generally, it refers to procedures that are required to treat a specific medical condition or alleviate related symptoms. Cosmetic procedures that are purely elective or performed for aesthetic purposes are usually not covered by health insurance.

Here are some situations where health insurance may cover cosmetic procedures:

- Reconstructive purposes: If a procedure is necessary to restore function or correct a deformity resulting from an accident, injury, illness, or congenital condition, it may be considered reconstructive rather than purely cosmetic. For example, reconstructive breast surgery following a mastectomy or surgery to repair facial fractures.

- Treatment of medical conditions: Some cosmetic procedures may be covered if they are considered integral to the treatment of a medical condition. For instance, rhinoplasty (nose surgery) may be covered if it is required to correct a breathing problem caused by a deviated septum.

- Psychological distress: In certain cases, health insurance may cover cosmetic procedures that address significant psychological distress caused by a visible condition. For example, a person with severe gynecomastia (enlarged male breasts) that causes emotional distress may be eligible for coverage.

It’s important to note that even when a cosmetic procedure meets the criteria for medical necessity, coverage may still depend on factors such as the specific insurance policy, the severity of the condition, and the documentation provided by the healthcare provider.

Making the Case for Insurance Coverage of Gynecomastia Surgery

When advocating for insurance coverage of gynecomastia surgery, it’s important to build a strong case demonstrating the medical necessity of the procedure. Here are some key points to include:

| Point | Description |

|---|---|

| 1. Medical condition | Emphasize that gynecomastia is a medical condition involving the development of excess glandular tissue in male breasts, causing physical discomfort, pain, or psychological distress. |

| 2. Failed non-surgical treatments | Highlight attempts at non-surgical treatments that have been unsuccessful in reducing symptoms or breast size, such as lifestyle changes, hormone therapies, or alternative treatments. |

| 3. Physical discomfort or pain | Describe physical symptoms like tenderness, swelling, or pain in the chest area caused by gynecomastia. Explain how these symptoms negatively impact quality of life and daily activities. |

| 4. Psychological distress | Emphasize the psychological impact of gynecomastia, such as emotional distress, body image issues, or social withdrawal. Provide supporting documentation, such as evaluations from mental health professionals, to demonstrate the psychological burden of the condition. |

| 5. Impaired social functioning | Illustrate how gynecomastia affects social activities, relationships, or professional settings, leading to limitations or negative experiences. |

| 6. Impact on overall well-being | Highlight the overall physical and mental well-being implications of gynecomastia, including decreased self-esteem, body dysmorphia, or difficulties in intimate relationships. |

| 7. Specialist recommendations | Include letters of support from qualified healthcare professionals, such as plastic surgeons or endocrinologists, attesting to the medical necessity of gynecomastia surgery based on their evaluation of the condition. |

| 8. Supporting medical documentation | Provide relevant medical records, diagnostic test results, and imaging studies confirming the presence and severity of gynecomastia to support the need for surgical intervention. |

| 9. Comparison to covered conditions | Draw comparisons to other medical conditions typically covered by insurance that involve reconstructive procedures or treatments aimed at improving quality of life. |

| 10. Policy review | Familiarize yourself with the specific language and guidelines in your insurance policy regarding coverage for gynecomastia surgery. Address any requirements or criteria mentioned to ensure your case meets those criteria. |

Remember to consult with a healthcare professional and carefully review your insurance policy for specific requirements and guidelines related to gynecomastia surgery coverage.

Defining Medical Necessity

Medical necessity refers to the assessment made by healthcare professionals, insurers, and regulatory bodies to determine whether a medical procedure, treatment, or service is essential for diagnosing, treating, managing, or preventing a specific medical condition. It is a critical criterion used to determine if an intervention should be covered by insurance or reimbursed.

Medical necessity is typically based on several factors, including:

- Diagnosis: The medical condition or disease must be accurately diagnosed and documented. The condition should be recognized as a legitimate medical issue supported by established medical standards and guidelines.

- Evidence-based practice: Medical necessity is often determined based on the availability of scientific evidence supporting the effectiveness and safety of the proposed procedure or treatment. This evidence is derived from clinical research, studies, and expert consensus.

- Improvement or preservation of health: The procedure or treatment should have a reasonable expectation of improving the patient’s health outcomes, reducing symptoms, preventing complications, or maintaining or restoring essential bodily functions.

- Alternatives and risks: Medical necessity takes into account whether there are viable alternatives to the proposed intervention and weighs the potential benefits against the risks and potential harm to the patient.

- Timing and urgency: The timing of the procedure or treatment may be considered, particularly if there is a need for immediate intervention to prevent further deterioration of the patient’s health or to address acute or life-threatening conditions.

- Cost-effectiveness: While not always a primary factor, cost-effectiveness considerations may come into play when determining medical necessity. This involves assessing whether the benefits of the intervention justify the associated costs, taking into account available resources and alternative, less expensive options.

It’s important to note that medical necessity can vary depending on various factors, including local regulations, insurance policies, and individual patient circumstances. The determination of medical necessity is typically made by healthcare professionals, insurers, or other relevant authorities based on clinical judgment and established criteria.

Gathering and Submitting Necessary Documentation

When gathering and submitting necessary documentation to your insurance provider, it’s important to be organized and thorough. Here are some steps to help you gather and submit the required documentation effectively:

- Understand the requirements: Review your insurance policy and any specific guidelines provided by your insurance provider to understand the documentation requirements for your particular procedure or treatment. Take note of any specific forms, codes, or supporting documents that are necessary.

- Consult with your healthcare provider: Speak with your healthcare provider, such as your doctor or specialist, to obtain the required documentation. They can provide medical records, test results, diagnostic reports, and any other relevant information that supports the medical necessity of the procedure or treatment.

- Complete any forms: If your insurance provider requires specific forms to be filled out, make sure to complete them accurately and thoroughly. Double-check that all necessary information is included and that the form is signed and dated as required.

- Ensure legibility and accuracy: Make sure that all documentation is legible and accurate. Illegible or incomplete records may cause delays or confusion during the review process. Check that names, dates, and medical information are correctly spelled and entered.

- Include supporting documents: Gather any additional supporting documents that can strengthen your case. This may include letters of medical necessity from your healthcare provider, clinical notes, pathology reports, or imaging studies. Provide any relevant information that demonstrates the medical need for the procedure or treatment.

- Keep copies of all documentation: Before submitting the documents to your insurance provider, make copies of everything for your records. This includes both physical and electronic copies. This ensures that you have a backup and can easily reference the documentation if needed.

- Submit the documentation: Follow the submission guidelines provided by your insurance provider. This may involve mailing physical copies, uploading electronic files through a secure portal, or sending documents via fax or email. Pay attention to any specific instructions and deadlines.

- Confirm receipt and track progress: Once you have submitted the documentation, contact your insurance provider to confirm receipt. Keep track of the progress of your request and follow up regularly to ensure that all necessary documentation has been received and that your case is being processed.

By being organized and thorough in gathering and submitting the necessary documentation, you can increase the chances of a smooth and efficient review process with your insurance provider.

Exploring Other Financial Assistance Options

If you’re seeking financial assistance for medical procedures or treatments beyond what your insurance covers, there may be other options available. Here are a few avenues to explore:

| Option | Description |

|---|---|

| 1. Medical financing | Explore financing options offered by medical providers, such as installment plans or medical credit cards with low or no interest rates. |

| 2. Flexible Spending Accounts (FSAs) | Utilize pre-tax funds set aside in an FSA or HSA, if available, to cover eligible medical expenses. |

| 3. Charitable organizations and foundations | Research charitable organizations or foundations that provide financial assistance or grants for medical expenses. |

| 4. Crowdfunding platforms | Create a crowdfunding campaign on platforms like GoFundMe or GiveForward to raise funds for medical expenses, sharing your story with friends, family, and the wider community. |

| 5. Negotiate payment plans | Discuss with your healthcare provider the possibility of setting up a payment plan based on your financial situation. |

| 6. Financial assistance programs | Inquire with hospitals or healthcare facilities about financial assistance programs that offer discounts, sliding-scale fees, or other forms of aid for patients who meet income requirements. |

| 7. Personal loans or lines of credit | Explore personal loans or lines of credit from financial institutions, comparing interest rates and terms to find the best option for your needs. |

Remember to evaluate each option carefully, considering your specific circumstances and financial capabilities. Additionally, seeking guidance from a financial advisor or healthcare financial counselor can provide valuable insights for your situation.

Alternatives to Insurance for Funding Your Procedure

If you’re looking for alternatives to traditional health insurance to fund your medical procedure, there are several options to consider. Here are some alternatives:

- Personal Savings: If you have savings set aside, consider utilizing those funds to cover the cost of the procedure. This option allows you to avoid interest charges or repayment obligations.

- Medical Credit Cards: Some financial institutions offer specialized medical credit cards that can be used to pay for healthcare expenses. These cards often come with promotional financing options, such as interest-free periods. However, be cautious about high interest rates or fees that may apply after the promotional period.

- Healthcare Loans: Explore loans specifically designed for medical expenses. Some financial institutions or online lenders offer healthcare loans with competitive interest rates and flexible repayment terms. Research different loan options and compare terms and interest rates to find the most suitable one for your needs.

- Medical Tourism: Depending on the procedure you require, you might consider traveling to another country where medical costs are lower. Medical tourism can provide access to quality healthcare at a more affordable price. However, it’s important to thoroughly research and choose reputable healthcare facilities and professionals.

- Health Savings Accounts (HSAs): If you have an HSA, you can use the funds deposited into the account to cover eligible medical expenses. Contributions to HSAs are tax-deductible, and the funds can be withdrawn tax-free when used for qualifying medical costs.

- Payment Plans: Speak with your healthcare provider to see if they offer payment plans that allow you to spread out the cost of the procedure over a period of time. This can make the expense more manageable by dividing it into smaller monthly payments.

- Medical Grants and Financial Assistance Programs: Research grants and financial assistance programs offered by nonprofit organizations, foundations, or local community resources. These programs may provide financial aid for specific medical conditions or to individuals in need.

- Fundraising and Community Support: Consider reaching out to your community, friends, and family for financial support. Utilize online crowdfunding platforms or organize local fundraising events to help raise funds for your procedure.

Remember to carefully assess each alternative and consider factors such as interest rates, repayment terms, eligibility requirements, and potential risks.

References:

- How to Get Gynecomastia Surgery Covered by Insurance. (n.d.). Plastic Surgery Austin. Retrieved Jan 11, 2023, from https://www.plasticsurgeryaustin.com/blog/how-to-get-gynecomastia-surgery-covered-by-insurance/

- Gynecomastia Surgery and Insurance Coverage: What You Need to Know. (n.d.). Austin Gynecomastia Center. Retrieved May 5, 2023, from https://www.austingynecomastiacenter.com/blog/gynecomastia-surgery-and-insurance-coverage-what-you-need-to-know/

- How to Get Gynecomastia Surgery Covered by Insurance. (n.d.). Stein Plastic Surgery. Retrieved Feb 15, 2023, from https://www.facialplasticsurgery.com/blog/how-to-get-gynecomastia-surgery-covered-by-insurance/